China’s trillion-dollar hydrogen market - how to predict industrial first movers

By Hansen Mou, PhD

Readers of this article are also reading:

When digital patent seeking can be the new lifeblood of non-tech industries

Executive Summary

EY reports that China has recently opened equity markets to more foreign institutional investors and increased sustainability reporting reliability on the corporate side. Concurrently, hydrogen clean-tech has been the fastest-growing sector of China’s global energy transition investment and is projected to become a trillion-dollar market in the next decade while currently boasting the world’s largest share of hydrogen fuel cell patent filings and a recent focus towards mass-automated production.

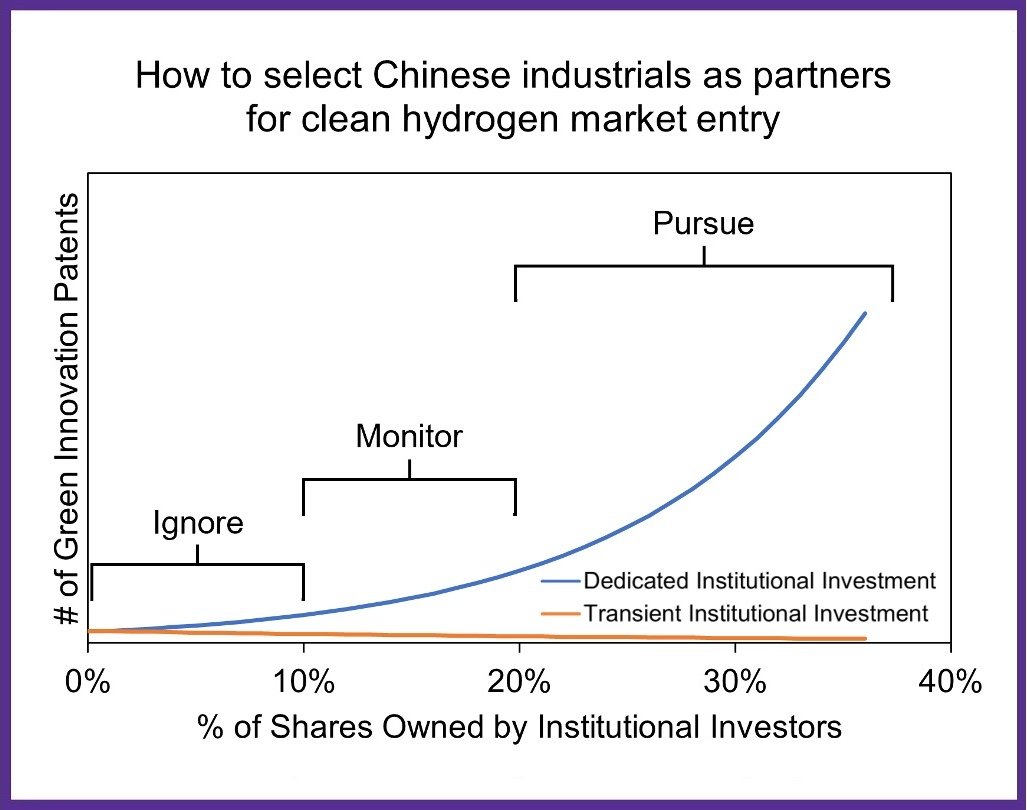

Research published in the Journal of Product Innovation found that higher levels of dedicated institutional investor ownership of Chinese manufacturing firms correlated to an exponential increase in their output of patents related to clean energy and sustainability.

Foreign companies looking to enter this promising Chinese hydrogen market should partner with companies with 20%+ of shares owned by dedicated institutional investment as they are most likely to be first-movers, and closely monitor those whose shares are on the rise (10-20% owned by dedicated institutional investors) for future prospects.

Impact: Chinese hydrogen market, and patenting, outpacing the world

In recent years, as the crippling effects of climate change lap at the doorsteps of billions across the globe, governments the world over have encouraged investment into the development of green technologies and innovations. Few among them can compare to that of China, whose $546 billion energy transition investment in 2022 cemented it as the global leader in green investment, accounting for over half of the global investment that year (“Global Low-Carbon Energy Technology Investment Surges Past $1 Trillion for the First Time”, BloombergNEF, January 2023).

The World Economic Forum predicted that China’s on-shore equity market will grow from $30 trillion to $100 trillion in the next decade as investment liberalization will lead to major shifts into capital markets by institutional investors (“3 reasons to take the long view on China”, World Economic Forum, January 2024). Furthermore, alongside its significant expansion of green finance markets and the launching of the world’s largest carbon trading scheme, analysis from EY found that China’s market for environmental, social, and governance (ESG) investment has grown rapidly as the Chinese government-issued new guidelines and stringent information disclosure requirements to strengthen investor confidence (“How is China creating an environment for world-class green investment”, EY China, August 2022).

Among the different green tech industries of China, hydrogen has shown the fastest pace of growth with investments tripling from levels a year prior—optimism for growth in this sector continues to be spurred on by the release of China’s Medium- and Long-Term Plan for the Development of the Hydrogen Energy Industry (2021-2035) in March of 2022. In this plan, Chinese authorities outlined their vision for the development of hydrogen infrastructure for its use in not only transportation, but also in applications for energy storage, power generation, and industry resulting in a projected trillion-dollar hydrogen market by the mid-2030’s, according to recent analysis from BCG (“China Hydrogen Industry Outlook”, BCG, August 2023).

The growth in patent filings by Chinese entities for hydrogen technologies reflects this trend in hydrogen investment. From 2011 to 2020, international patent filings for hydrogen technologies originating in China increased at an average annual rate of 15.2% (“Hydrogen patents for a clean energy future”, International Energy Agency (IEA), January 2023. This growth was reflected particularly in the transportation sector, as China has enjoyed the highest share of hydrogen fuel cell patent filings in the world since 2015. While the top twenty Chinese entities in patent portfolios only included two private companies (IGE Wuhan and FAW Group, the rest being the government or universities), a majority of the major Chinese companies are actively developing at least some patents in this technology. In China, recent patent filings have exhibited a particular push towards the mass automated production of hydrogen fuel cell technologies, indicating a greater effort in green innovation from Chinese manufacturing firms (“Patent Landscape Report – Hydrogen Fuel Cells in Transportation”, World Intellectual Property Organization (WIPO), 2022).

Findings: institutional investors pressuring Chinese industrials to go green

Hydrogen has become the focus of study and investment around the globe as countries seek to unlock its clean energy potential and clean up their industrial sectors. Among them, China has positioned itself as the world’s biggest player and drawing significant foreign investment. But with such a rapidly evolving market, how do investors know which firms they should target for the best opportunities? A recent study from the Journal of Product Innovation Management provides a clue, finding that a higher share of ownership by dedicated institutional investment strongly correlated to the firm’s increased pursuit of patents in green innovation. The presumption being that institutional shareholders would influence long-term green innovation projects if they could impact firm managerial decision-making by holding sufficient company shares.

To measure green innovation, the authors collected data on 5,473 Chinese manufacturing firms regarding their green or sustainable invention and utility-model patent applications from the China National Intellectual Property Administration (CNIPA) as well as environmental management system certification (ISO 14001 or GB/T 24001) from China’s Certification and Accreditation Administration (CNCA) from the years 2013-2019. To compare the degree of institutional investment, the authors identified the top 10 shareholders of the firms and categorized each by their degree of shareholding independence and their portfolio concentrations. The investors were characterized as either (1) “dedicated” institutional investors, (mainly long-hold funds, pension funds, and QFIIs), or (2) “transient” institutional investors, (mainly insurance, banks, trusts, and securities). The two groups defined in the study did not encompass all possible investors, only focusing on the top 10 shareholders and not individual investors. Portfolio concentration was measured simply by their own percentage of the company’s outstanding shares.

The resulting data found that the Chinese manufacturing firms varied significantly in their levels of green innovation—up to 76 patents per year with an average of less than 2—and dedicated institutional investor ownership – up to 35.4% with an average of 2.2%. Regression analysis found that the number of green patents correlated positively with ownership by dedicated institutional investors and negatively with ownership by transient institutional investors. Specifically, every 1% increase in institutional ownership corresponded to the total annual green patents increasing at a continuously compounding rate of 98.5%. This is to say that the more dedicated investors a company had, the more green patent applications they filed, and vice versa.

However, the study found that when incorporating the moderating effects of the firm’s financial performance (measured by stock return) and financial constraint (determined by the Kaplan-Zingales Index, a measure of a firm’s dependence on external financing), dedicated institutional investors were only more likely to drive green patents when the Chinese industrial firms presented positive financial outlooks. The correlation did not statistically hold in the face of financial headwinds. In contrast, high levels of transient institutional investors did not correlate to green innovation during times of favorable financial outlook, and their presence when financial performance lagged resulted in under-production of green innovation. This meant that when a company was financially healthy, more dedicated investors led to more green patent filings, whereas when a company was financially unhealthy, more transient investors hindered a company’s green innovation.

Recommendations: getting the first jump at the first movers

The future looks bright and opportunities appear bountiful for China’s hydrogen market. Investors seeking to break into this market should take a cue from the institutional ownership profile of their prospective Chinese industrial business partners. As government support expands for green tech, and their equity markets draw more institutional investors, foreign firms interested in hydrogen in the Chinese industrial market should take preemptive steps to best position themselves:

First Step: Take the time to analyze the profile of ownership of prospective publicly traded Chinese manufacturers. As higher degrees of ownership by “dedicated” institutional investors correlated strongly with interest in green innovation, these Chinese manufacturers would be the most opportune targets for collaboration and the most likely first-movers (say 20%+ shares owned by dedicated institutional investors). However, these firms must be analyzed for their financial prospects as well, as poor financials limit investor support for green innovation, and the presence of more “transient” institutional investors.

Ongoing: Track changes in institutional ownership of the Chinese manufacturers going forward (particularly amongst those with 10-20% shares owned by dedicated institutional investors), looking for sudden increases that may drive a substantial change in sustainability projects they undertake. This will allow the first jump at the first movers.

Finally: Do not ignore the other signals. While this study focused on using the number of patent filings as a metric for green innovation, it is unclear whether this effect is correlation or causation. Additionally, other metrics may be relevant to different sectors, such as actual expenditures on new sustainability projects. These sorts of metrics may serve as more direct indicators as patent filings may only be a necessary but not sufficient condition for actual corporate action.

The research discussed herein considers Chinese manufacturing firms before the COVID pandemic from 2013-2019. As China’s economy has struggled to regain traction since the pandemic, and green patenting is also linked so closely to the financial performance of the target company, the institutional investor pressures may have weakened. In addition, faltering trade relations with the US and recent reports of slowing economic growth present potential challenges for foreign investors interested in the Chinese market.

Alongside the geopolitical risks, the development of new hydrogen technologies present significant market risks, particularly in regards to uncertainty in growth in demand for hydrogen-powered electricity generation (“Global Energy Perspective 2023: Hydrogen outlook”, McKinsey & Co., 2024). But even under those circumstances, with demand for clean hydrogen projected to grow significantly across the globe and given the projected growth of the Chinese hydrogen market from so many studies released after the pandemic, the opportunities are likely to expand regardless.

____________________________

Hansen Mou was awarded a PhD in Chemical Engineering from the Columbia University and is a member of the Columbia Graduate Consulting Club. The research applications proposed in this article are solely the views of the author and do not necessarily reflect the views of the original academic journal article authors nor any individual member of our Editorial Board.