The trick for using “green bonds” to access institutional equity

By Josiah Rudge

Readers of this article are also reading:

China’s trillion-dollar hydrogen market - how to predict industrial first movers

Executive Summary

Analyses from both McKinsey and BCG show investors expect convincing “equity stories” connecting corporate green initiatives to long-term value creation. But are there ways beyond simple announcements (say issuance of a green bond) to offer a material and unambiguous way to make that connection?

Research published in the Journal of Financial Economics finds that green bond issuance comes with no higher interest rate than a conventional bond, a slight bump in stock price, and a 2.9% increase in equity ownership by green institutional investors. Thus green bonds, despite criticisms of requiring certification costs or just being a form of “green-washing”, are not inferior to conventional bonds and if the right conditions are met, have extra benefits.

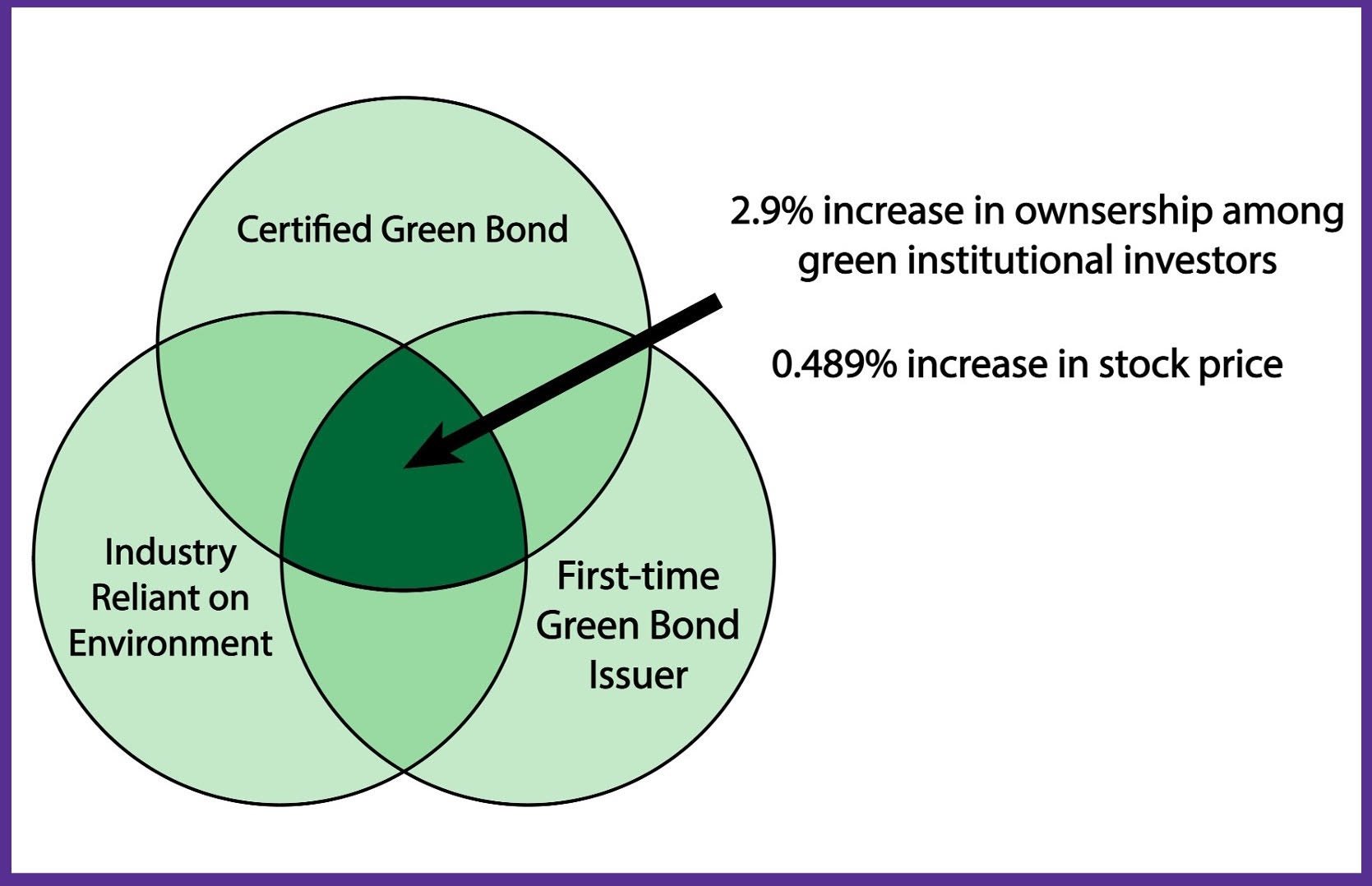

This impact is realized only if: (1) the green bond is certified, (2) the company is in an industry that is reliant on the natural environment, and (3) this is the first green bond issued by the company.

Telling the “equity story” institutional investors want to hear

The Ceres Investor Network on Climate Risk and Sustainability, a group used to designate green investors, is a network of 220 institutional investors that totals over $46 trillion in AUMs. This is in fact a significant proportion of global AUMs and includes many of the largest pensions funds and money managers in the world, offering an investor class many companies may not normally attract.

Apart from that specific network, a McKinsey report (“Investors want to hear from companies about the value of sustainability”, McKinsey, 2023) found that 85% of all Chief Investment Officers already consider ESG as a factor in their investment decisions and a whopping 83% would expect to pay an ESG premium all else (cash flows and risk) being equal. But these institutional investors need to hear HOW the initiative creates value – an “equity story” – via growth or risk mitigation.

This is echoed by research from BCG (“Investors want to know your sustainability business case”, BCG Corporate Finance and Strategy, 2023), which suggests green initiative announcements that include at least five of seven key value creating explanations (material to company/sector, connected to core business, clear on funding, tangible goals, third party verified, and related to value) will increase stock price versus those that include two or fewer which cause a decline in stock price.

Green bond yearly issuances have grown from $5 billion to over $500 billion between 2013 and 2021. But is it prudent for a CEO/CFO to be choosing green bonds over any other? Green bonds may be an alternative way to de facto meet most of the criteria found by BCG in a clear, unambiguous manner that other green initiative announcements often lack. Even without an impact on the equity price, gaining access to the large and growing capital market like the Ceres Investor Network for financing from green investors could be a major aspect of corporate planning and investor relations.

Quantifying the equity impact of green bond issuance

A recent study in the Journal of Financial Economics seeks to explore the impact on equity price, green bond cost of capital, and response from traditional institutional investors to a green bond issuance. A dataset of corporate green bonds was compiled from Bloomberg’s fixed income database, excluding government bonds. This yielded 1,189 corporate green bonds issued between 2013 and 2018. Standard & Poor’s Compustat was used to assess stock market reaction to bond issuance. Ownership data came from Thomson Reuters.

First, the cumulative abnormal return (CAR) of stocks was calculated for a 60-day window around the announcement of a green bond issuance and showed a CAR of 0.489% (statistically significant but not huge). However, this positive CAR only existed for certified green bonds, first time green bond issuers, and issuers in industries reliant on the health of the natural environment (for example, utility companies that can take advantage of renewable energy sources, or real estate development that is concerned with flood prevention).

Second, green vs. conventional bond pricing was studied by comparing bond issuances that match closely in other metrics. There was no difference found in their yield rate at issue. Thus they are seen as equivalent risks to debt investors and carry no more burden than regular bonds.

Third, green bond issuers and conventional bond issuers were compared to see how a company’s equity ownership makeup changed after green bond issuance. There was no change in ownership from institutional compared to regular investors; however, within institutional investors, ownership increased among those designated as long-term by 2.2% and among green investors by 2.9%. Long-term investors were defined as those that hold stock for longer than the median investor and green investors were those with membership in the Ceres Investor Network on Climate Risk and Sustainability.

In summary, the research found (1) a boost in stock valuation for green bond issuers (under the right conditions), (2) equal yield rate at issue between green and conventional bonds, and (3) increased ownership among institutional long-term and green investors without any change in non-green institutional ownership.

Only one bite at the green money apple

Green bonds, despite criticisms of requiring certification costs or just being a form of “green-washing”, are not inferior to conventional bonds in term of yield rates at issue. If anything, they are advantageous as they can provide a bump in market valuation and skew ownership towards long-term institutional and green investors that control a massive part of the equity capital markets. To ensure the firm’s green bond issuance can secure the best corporate benefits, consider the following:

Day One: Know the pre-requisites for an impactful green bond issuance: certification, first time issuance, and relation to industry reliant on the environment. The source article did not assess these prerequisites’ effect on long-term green institutional ownership (only stock price), but to be safe, consider these necessary elements that tell the “equity story” best.

After: Inform and convince other relevant stakeholders within the company of this potential value of using green bonds to message a sustainability project. This is not just for the CEO and CFO, but for the entire investor relations team, as well as strategy and operations managers.

Finally: Identify and advertise to potential investors that value of the green initiative for which the bond is issued: the ownership changes amongst the Ceres Investor Network observed in the source article only became statistically significant after two years of bond issuance, so making an additional announcement in the traditional way may still be necessary.

A key consideration is that green bonds were once rare and thus “stood out” more – over time, they may become so commonplace that they lose some of their signaling strength. The time to take advantage may be now.

____________________________

Josiah Rudge is a PhD student in BioEngineering at the Georgia Institute of Technology and a member of the GA Tech PhD-2-Consulting Club. The research applications proposed in this article are solely the views of the author and do not necessarily reflect the views of the original academic journal article authors nor any individual member of our Editorial Board.